We all know e-commerce has exploded over the past 24 months. Google knows all too well. The surge in e-commerce was a boon to rival Amazon in terms of search traffic and revenue gained. But as we’ve reported, Google has also been working hard to fight back by becoming a stronger e-commerce player. And it looks like Google is gaining ground, as a newly published report from Morgan Stanley suggests.

Morgan Stanley says that in November 2021, 57 percent of shoppers first went to Google platforms (including Search and YouTube) to research a new product, up from 54% in May 2021. In addition, the number of Amazon Prime subscribers turning to Google for initial searches increased to 56 percent from 51 percent in the same period.

This is good news for Google, whose core advertising business has been losing market share to Amazon Advertising. Google needs to keep eyeballs on Google in order to attract and keep advertisers. And people searching with intent to buy are incredibly valuable. Morgan Stanley predicts that Google will achieve 37 percent year-over-year e-comm/retail ad spend for fiscal 2021.

It’s interesting to note that according to online selling platform Jungle Scout, 74 percent of U.S. consumers begin their product searches on the Amazon.com site in 2021. It’s impossible to do an apples-to-apples comparison with Morgan Stanley’s numbers because Morgan Stanley counts YouTube searches, and Jungle Scout does not. This is a significant difference because YouTube is the second-most popular search site in the world next to Google Search.

That said, the numbers matter.

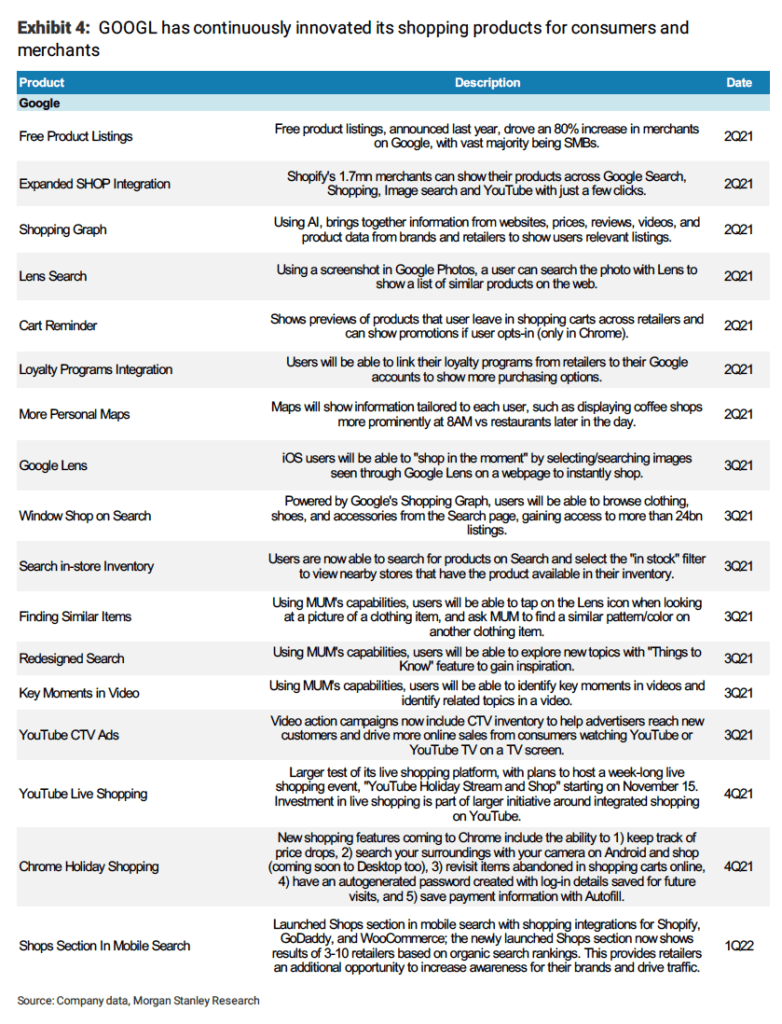

Morgan Stanley listed several examples of how Google has developed more e-commerce related features in 2021 alone:

These examples stand out for us:

- Making online searching and shopping more visually appealing by emulating the product display features you see on Amazon. For certain items such as apparel, Google will return search results with a product results that page that resembles a visual store, not a list of links and text descriptions.

- Soon introducing a new way to search visually, with the ability to ask questions about what you see. According to a Google blog post, “With this new capability, you can tap on the Lens icon when you’re looking at a picture of a shirt, and ask Google to find you the same pattern — but on another article of clothing, like socks. This helps when you’re looking for something that might be difficult to describe accurately with words alone. You could type ‘white floral Victorian socks,’ but you might not find the exact pattern you’re looking for. By combining images and text into a single query, we’re making it easier to search visually and express your questions in more natural ways.”

- Including in search a feature, “Things to know,” that will make it easier to explore and understand new topics. For example, if a person searches for “acrylic painting,” Google understands how people typically explore this topic, and shows the aspects people are likely to look at first though “Things to know.” Google says it can identify more than 350 topics related to acrylic painting in this example.

These advances are typically fueled by artificial intelligence applications such as multitask uniform model, an algorithm designed to provide answers to complex queries by concurrently assessing information across multi-language text, images, video and audio.

The next milestone: Google’s parent Alphabet reports fiscal 2021 earnings on February 1. Let’s see how well Google’s ad revenues look.

What Advertisers Should Do

- Capitalize on Google’s advertising tools that are designed to be more visually appealing. For instance, Google recently rolled out Discovery ads, which are image-rich ads designed for a more “laid back” search experience (more about that here). Google is clearly doubling down on the visual web, and advertisers should expect more visually appealing ad products as it attempts to become a stronger e-commerce player.

- Take a closer look at video advertising and organic content sharing, given Google’s interest in building out a more robust search experience on YouTube. Earlier in 2021, we predicted a surge in online video consumption, a reality that has been borne out during the pandemic.

- Make use of more tools that make it easier to connect online searching and shopping. Google isn’t the only company figuring out search and commerce. Instagram is another, as we discussed in a blog post recently. And there are many more apps doing the same thing.

- Do a gut-check with your organic search team. How well are they aligning content with visual search, for example? How will Google’s “Things to know” feature affect the depth and breadth of content that you provide on your website, Google My Business listing, and elsewhere?

- Keep your eyes open and your budgets flexible. The online advertising space is getting more competitive and interesting for retailers. We have been blogging about the rise of Amazon Advertingfor some time – as well as the growth of advertising services from retailers such as Macy’s, Walmart, and Walgreens. They’re all using their first-party customer data to build online advertising platforms. Depending on your target audiences, they may provide very competitive alternative to Google – an example being Macy’s for fashion-conscious shoppers or Walmart for advertisers whose audience aligns with Walmart’s multi-channel customer. (And we can help you succeed on all these platforms.)

Contact True Interactive

To succeed with online advertising, contact True Interactive. Read about some of our client work here.

Image source: https://pixabay.com/photos/eye-google-detail-macro-face-1686932/