Meta is back.

The company’s market capitalization lost considerable value in 2022 after failing to meet its financial targets. A costly investment into the emerging metaverse has been ridiculed. But Meta is showing signs of a much brighter 2023.

The Wall Street Journal recently reported that:

- The company’s investments into artificial intelligence (AI) have helped Meta improve ad-targeting systems to make better predictions based on less data.

- Meta’s short-form video product, Reels, is becoming more popular on Meta’s core Facebook and Instagram platforms.

- The development of ad products based on user data from Meta’s own platforms is easing the blow of Apple’s privacy restrictions. Those restrictions, focusing on ad products that rely on third-party user data, had forced Meta to retool its ad strategy away from third-party user tracking to first-party data (the information that Meta gains from users from its own platforms such as Facebook and Instagram).

Reels Gains Traction

All of these developments are noteworthy. For instance, Reels is Meta’s answer to TikTok, whose dramatic rise, based on short-form videos, has threatened Meta. So, more user engagement with Reels should attract more advertisers.

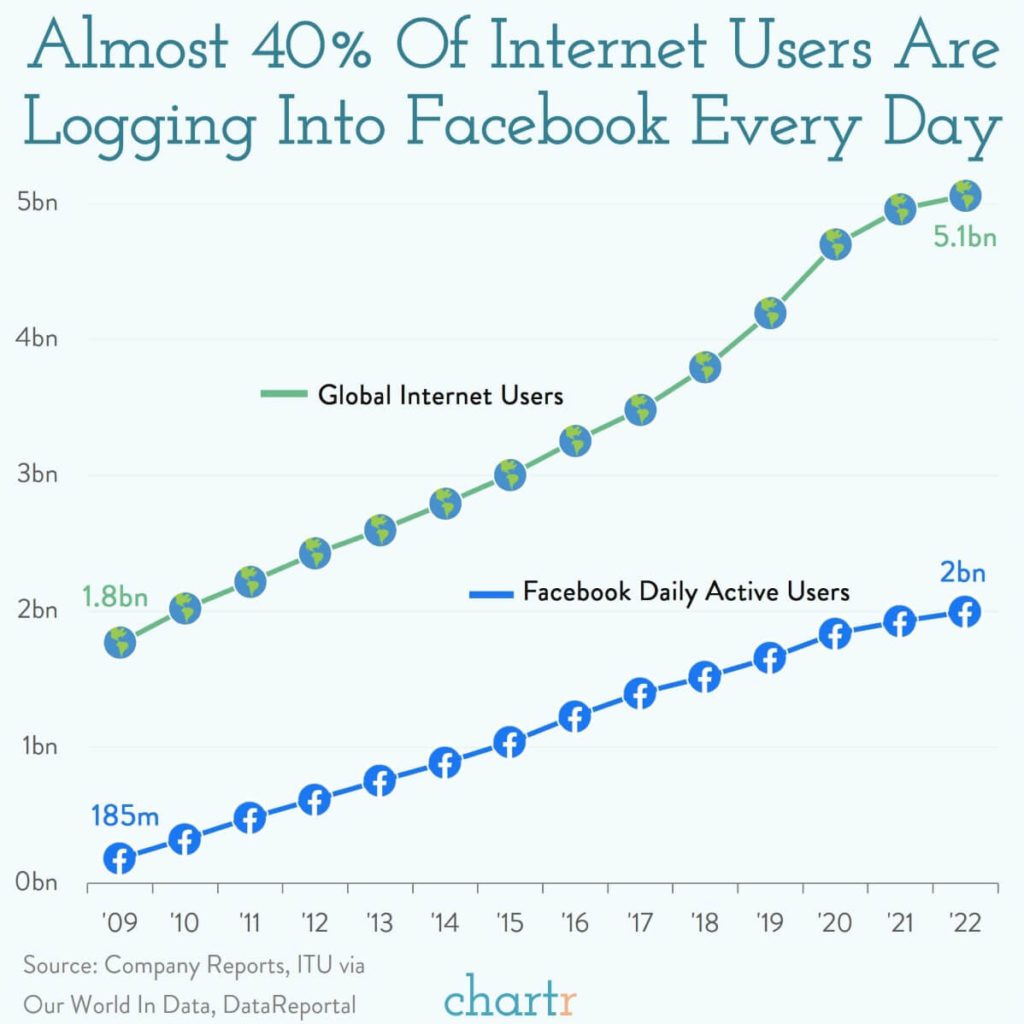

The Wall Street Journal said that Tom Alison, head of Facebook, wrote in a memo to staff, “Facebook engagement is stronger than people expected. Our internal data indicates that Meta has grown to a meaningful share of short-form video.” And on Facebook alone, Meta can count on a large, engaged user base.

Reportedly, Meta has credited improvements to both Facebook’s algorithms and the computing systems on which they run, resulting in a 20 percent gain in time spent in Reels consumption. This is quite a turnaround from summer 2022, when Meta was still struggling to get users to embrace Reels videos.

More Effective Ad Products

Meta suffered a blow in 2021 when Apple introduced privacy controls that resulted in people opting out of having their online behavior tracked while using Apple products. This was a problem because Meta’s ad products rely mostly on tracking people across the web via third-party cookies. The privacy controls have forced Meta to do a better job building ad products based on user behavior on Meta’s own platforms (which Apple’s privacy controls do not affect).

Meta estimated last February that the Apple change would cost it more than $10 billion in lost sales for 2022, equivalent to about 8 percent of its total revenue for 2021. At the time, the news caused Meta’s stock price to plummet.

But Meta is gaining traction with new ad products. For instance, Meta’s broad targeting ad program consists of an automated targeting approach that reportedly produces better results for Facebook and Instagram ads than more refined, more niche audience approaches do. Meta is also developing ads in which users click straight into a messaging conversation with a business.

But ads based on first-party data are only 18 percent of Meta’s revenue, according to The Wall Street Journal. Meta has a lot of work to do.

Key Issues Going Forward

Meta recently reported better-than-expected results in its most recent quarterly earnings announcement. CEO Mark Zuckerberg said 2023 is a “Year of Efficiency,” which means managing spending carefully. Key questions going forward:

- How well Meta will use AI to recommend Reels content to Facebook and Instagram users. The more targeted the recommendations, the higher the engagement rates. Meta needs people to stay engaged on Reels like they are glued to their TikTok videos. Engagement means advertising revenue from businesses that want to target those users with content.

- The performance of ad products based on first-party data. Businesses should continue to ask their Meta ad representatives for developments in this area.

- How well Meta manages its costly investment into the still young metaverse, which remains a sore spot for the company. The metaverse generates no advertising revenue streams to speak of for Meta.

At True Interactive, we advocate for our clients that invest in Meta and other platforms. We will continue to monitor developments and adapt our ad strategies as needed.

Contact True Interactive

To succeed in the ever-changing world of online advertising, contact True Interactive. Read about some of our client work here.

Lead photo credit: https://unsplash.com/@solomin_d