Unless you’ve been living under a rock, by now you know that Facebook announced the creation of a parent brand known as Meta. Facebook still keeps its name to refer to the social media app. But Meta now coordinates Facebook, WhatsApp, Instagram, and other brands that Facebook has been launching or buying over the years. The announcement cast a spotlight on the fast-growing metaverse. But it also drew attention to Facebook’s ongoing reputation problems, which became more intense in recent weeks with the publication of the Facebook Files in The Wall Street Journal. Many branding experts and industry watchers asked whether the name change will help Facebook overcome its latest reputation crisis. I have another question: how much of a threat is Facebook’s (now Meta’s) reputation crisis in the first place?

According to the Facebook Files, Facebook has knowingly allowed its algorithm to publish harmful and divisive content on users’ news feeds. The accusations have been supported by documents shared by a former employee turned whistleblower, Frances Haugen. She has also shared her findings with Congress. The blowback has been strong. Legislators have accused Facebook of subverting democracy. Facebook bashers have vowed to stop using the app.

But what will advertisers do?

This is an important question. Obviously this is not the first reputation crisis Facebook has encountered — and I’m referring specifically to the social app Facebook, not Meta, WhatsApp, or Instagram. On at least one occasion, some advertisers have responded by boycotting Facebook temporarily or permanently. But Facebook’s advertising growth suggests that the company’s reputation problems have not resulted in a long-term advertising decline. Here are two reasons why:

Advertisers Are Used to Conflict

The fact that a publisher and aggregator of news content (which is what Facebook does) knowingly shares divisive information is not exactly shocking news to advertisers. Mainstream news media have been attracting audiences by publishing divisive content for decades, long before the internet existed. And they’re doing so today. As a result, advertisers probably have a higher tolerance for conflict than Facebook’s critics do. This, to me, is the most powerful and compelling point to bear in mind. Advertisers don’t want their ads to appear alongside inappropriate content. But no one is accusing Facebook of allowing that to happen. The existence of controversial content, in and of itself, probably won’t be enough to create an advertising exodus. So long as Facebook manages brand safety well (a problem that has vexed apps such as YouTube), advertisers will tolerate conflict.

It’s All about the Audience

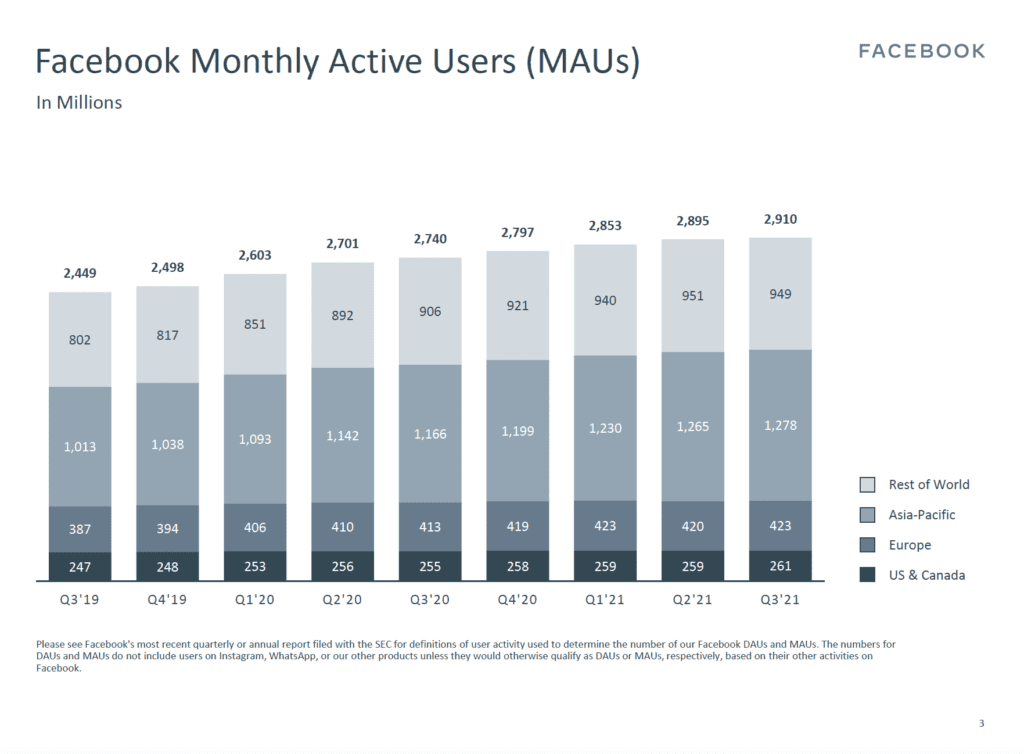

Facebook’s strategy of building and engaging users has angered critics, but it has also helped Facebook build a bigger user base. This chart from Facebook’s latest earnings announcement is telling:

Advertisers are looking at these numbers, too. More users on Facebook is obviously attractive to advertisers. They’re going to go where the users go. It’s a simple as that.

Advertisers are looking at these numbers, too. More users on Facebook is obviously attractive to advertisers. They’re going to go where the users go. It’s a simple as that.

The Real Threat to Facebook

Based on advertiser behavior, the bigger threat to Facebook consists of stronger privacy controls – especially from Apple. As widely reported, Apple rolled out an update to Apple’s operating system in 2021 that included an important privacy control known as Application Tracking Transparency (ATT). ATT requires apps to get a user’s permission before tracking their data across apps owned by other companies for advertising, or sharing their data with data brokers. Apps can prompt users for permission, and in Apple Settings, users can see which apps have requested permission to track so they can make changes to their choice at any time.

Advertisers have feared that ATT will trigger an uptick in users opting out to having their behavior tracked. Consequently, advertisers will have a harder time serving up targeted ads because they cannot track user behavior. This concern is well founded. As many as 96 percent of users in the United States are opting out of having their behavior tracked. And as a result, social apps have (so far) lost $10 billion in ad revenue. Facebook itself forecast a pullback in ad revenues for the fourth quarter because of the significant uncertainty it faces in the fourth quarter in light of continued headwinds from Apple’s iOS 14 changes.

If you advertise on Facebook, I’d love to hear your thoughts on this topic. What factors might influence your choices going forward?

Contact True Interactive

To succeed in the dynamic world of online advertising, contact True Interactive. We help businesses succeed with relevant and engaging advertising. Read about some of our client work here.