While all eyes were on Amazon’s streaming deal to broadcast NFL Thursday Night Football, YouTube waltzed in and pulled off an upset. YouTube signed a seven-year deal worth an average price of $2 billion a year to secure rights to the NFL Sunday Ticket franchise.

This is a big move for YouTube. Sunday Ticket is a subscription-only package that allows customers access to all Sunday afternoon games for out-of-market teams. DirecTV currently pays the NFL an average fee of $1.5 billion per season for both residential and commercial rights. Its deal expires after the current season.

Sunday games represent peak prime football. NFL Thursday Night Football (TNF), by contrast, typically features subpar games largely because the Thursday timing does not give teams enough time to prepare after their previous Sunday games. Amazon’s ratings for TNF broadcasts have been spotty although four games rank among the Top 100 most viewed telecasts of 2022 according to Nielsen.

YouTube reportedly bested Amazon, Apple, and ESPN to secure the rights. YouTube will offer Sunday Ticket as an add-on to YouTube TV (a subscription streaming service that lets you watch live TV from major broadcast and popular cable networks) and in the video platform’s main app through a service called Primetime Channels that allows viewers to subscribe to individual channels.

Here are some takeaways from the agreement:

- YouTube has put a major stake in the ground at a time when the app’s dominance has been challenged by TikTok. In 2022, TikTok ranked ahead of YouTube on Cloudfare’s rankings of the most visited sites of the year. YouTube’s most recent quarterly advertising revenues came in below analysts’ expectations while TikTok’s ad revenue continued to make impressive gains. YouTube has been answering the rise of short-form video by launching its own TikTok imitator, Shorts. But YouTube is just getting started monetizing Shorts with advertising. The NFL, easily the most popular viewing draw on television, creates a powerful content machine for YouTube to attract advertising money. But at what cost? DirecTV had been losing about $500 million annually on the package, according to The Wall Street Journal.

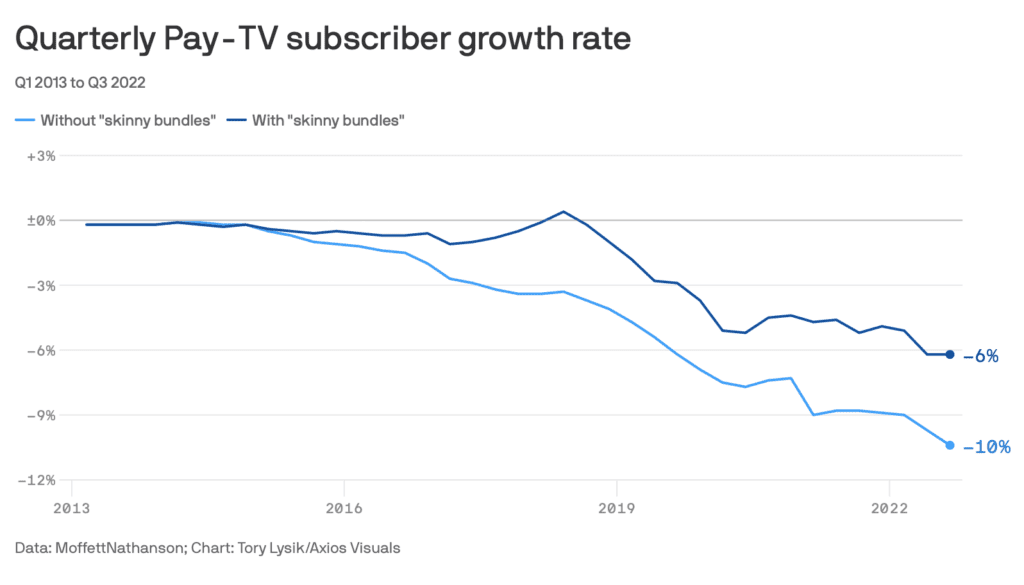

- The deal is another sign that connected TV (CTV) is the future. For the first time, streaming viewership topped cable in 2022, and this trend is not going to reverse course as cord cutting continues. As reported in Axios recently, traditional television companies and major media firms are bracing for further declines in the ad market and yet another increase in cord-cutting this year. “The migration of the country’s biggest sports rights packages from linear TV networks to streaming will expedite the inevitable collapse of the cable bundle,” Axios noted. At True Interactive, we believe it’s important that businesses understand the growth of advertising on streaming platforms in context of the rise of connected TV. If you’ve not done so already, take a closer look at why connected TV is growing and how it could expand your audience. (True Interactive can help you with that.) Connected TV is enjoying 60-percent growth, driven by a public’s appetite for streaming that continues unabated. Connected advertising is similar to linear TV advertising because both formats rely obviously on video. But connected TV is different in many important ways. For one thing, advertisers need to understand how to create video content that will reach viewers across a variety of viewing devices in addition to TV screens, and connected TV ads are competing with multiple content streams. You can watch Amazon’s TNF on a laptop, mobile phone, or gaming console with multiple screens open. The same will hold true for watching NFL Sunday Ticket via YouTube TV. YouTube offers a number of connected TV ad units including its Masthead ad format. YouTube has added more CTV formats recently and will certainly offer more as its competitors such as Amazon do the same.

- This a victory for first-party data, which is the information that businesses collect directly from their customers. YouTube will use first-party data to sell targeted ads to help drive revenue for the games. Right now, third-party audience data is withering away thanks to Apple’s and Google’s privacy measures. Businesses that figure out how to monetize first-party data enjoy an enormous advantage. YouTube is the second-most popular search platform in the world (behind Google). The company will be well positioned to us first-party data to sell targeted ads to NFL viewers.

The 2023-24 NFL season seems a long way off. YouTube still needs to deliver on investor expectations for parent company Alphabet between now and then. Look for YouTube to expand even more into the lucrative live sports field, which is still up for grabs among streaming platforms. Meanwhile, Alphabet’s next earnings announcement is February 7, 2023. Let’s see how YouTube’s advertising revenue delivers.

Contact True Interactive

True Interactive can help you navigate the connected TV landscape. Our services range from media strategy and planning to automated performance reporting. Learn more about our services here, and contact us to learn more.