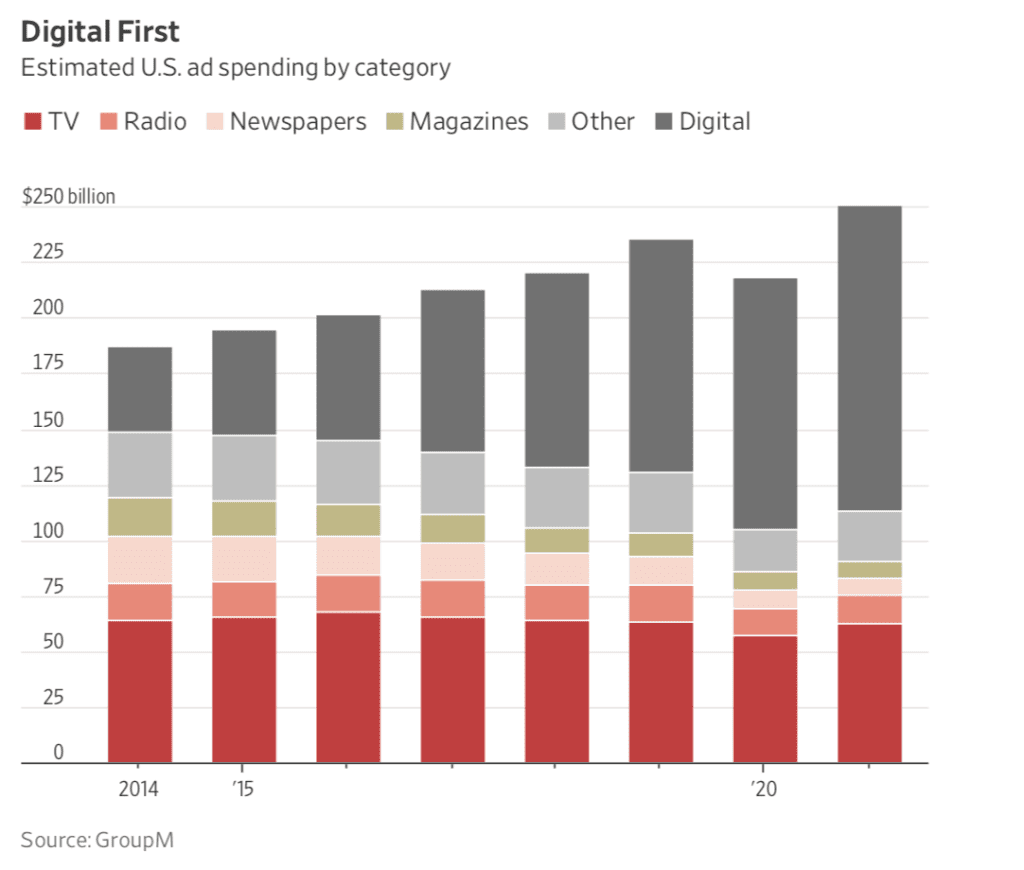

Ad spending is surging. As reported in The Wall Street Journal, U.S. companies are expected to spend 15 percent more on advertising in 2021 year than they did in 2020. That’s because consumer confidence is increasing, and the pace of Covid-19 vaccinations is accelerating. And digital is getting a bigger share than ever of the advertising pie:

Announcements from technology giants and social media apps in recent days underscore just how much businesses are investing into digital advertising:

- As we reported on our blog, Amazon Advertising and Facebook reported strong year-over-year ad revenue growth in their most recent quarterly earnings announcements.

- Alphabet announced 32 percent year-over-year ad growth for Google, demonstrating an impressive rebound from a slump triggered by the pandemic.

Amid this spending surge, we see some important lessons emerging:

- Businesses that maintained their spending levels during the depths of Covid-19 in 2020 are at an advantage over those who pulled back and are now kickstarting their spending. Consumer behavior and sentiment are changing faster than ever. We predicted in 2020 that reducing ad spend during the pandemic would catch businesses flat-footed when consumer behavior shifted again – as it has done in 2021.

- We’ve hit an inflection point with digital. As the stay-at-home economy takes hold, consumers are remaining online at higher levels than ever. As a result, online spending continues to accelerate. Businesses that asked, “But how long will the growth last?” in 2020 fell behind those that saw the surge for what it is: a behavioral change. The faster businesses adapt to those changes by boosting their online advertising, the sooner they’ll attract shoppers online.

- The tech giants are experiencing a golden era. We’ve seen the tech giants – namely Amazon, Apple, Facebook, Google, and Microsoft – experience heavy criticism in recent years for reasons too numerous to summarize in a blog post. And of course the specter of antitrust lawsuits looms over Facebook and Google (and Apple in Europe). On top of that, they’re at war with each other, and the demise of third-party cookies calls into question how well advertisers will be able to target consumers across these platforms. But guess what? Amid the blowback, the tech giants continue to run the table, as noted above. Smart advertisers aren’t allowing negative headlines to scare them away from the tech giants. They’re watching how these platforms innovate with new ad units that monetize the surging online audience.

- Retail ad platforms are on the rise. Savvy marketers are capitalizing on the fact that retailers such as Amazon, Dollar Tree, Kroger, Macy’s, Target, and Walmart are monetizing their first-party customer data by building ad businesses. Each retailer can give advertisers access to different types of consumers. We expect more of these platforms to emerge, contributing to robust ad growth.

- Social commerce is going to fuel more ad spending. As we discussed on our blog recently, businesses should capitalize on social commerce advertising tools such as Pinterest Product Pins, through which a business can connect its product catalog to Pinterest, filter and organize inventory, create shopping ads, and measure results; or numerous ad units on Instagram that make it easier for businesses to turn advertising into shopping experiences.

We urge businesses to take a fresh look at how your customers’ journeys are changing amid the rise of digital-first living and spending. Monitor performance closely as consumer behavior fluctuates. Businesses that invest in strong real-time analytics tools will have the upper hand.

Contact True Interactive

At True Interactive, we know how to help businesses navigate the complex waters of online advertising. Contact us. Learn more about our work here.