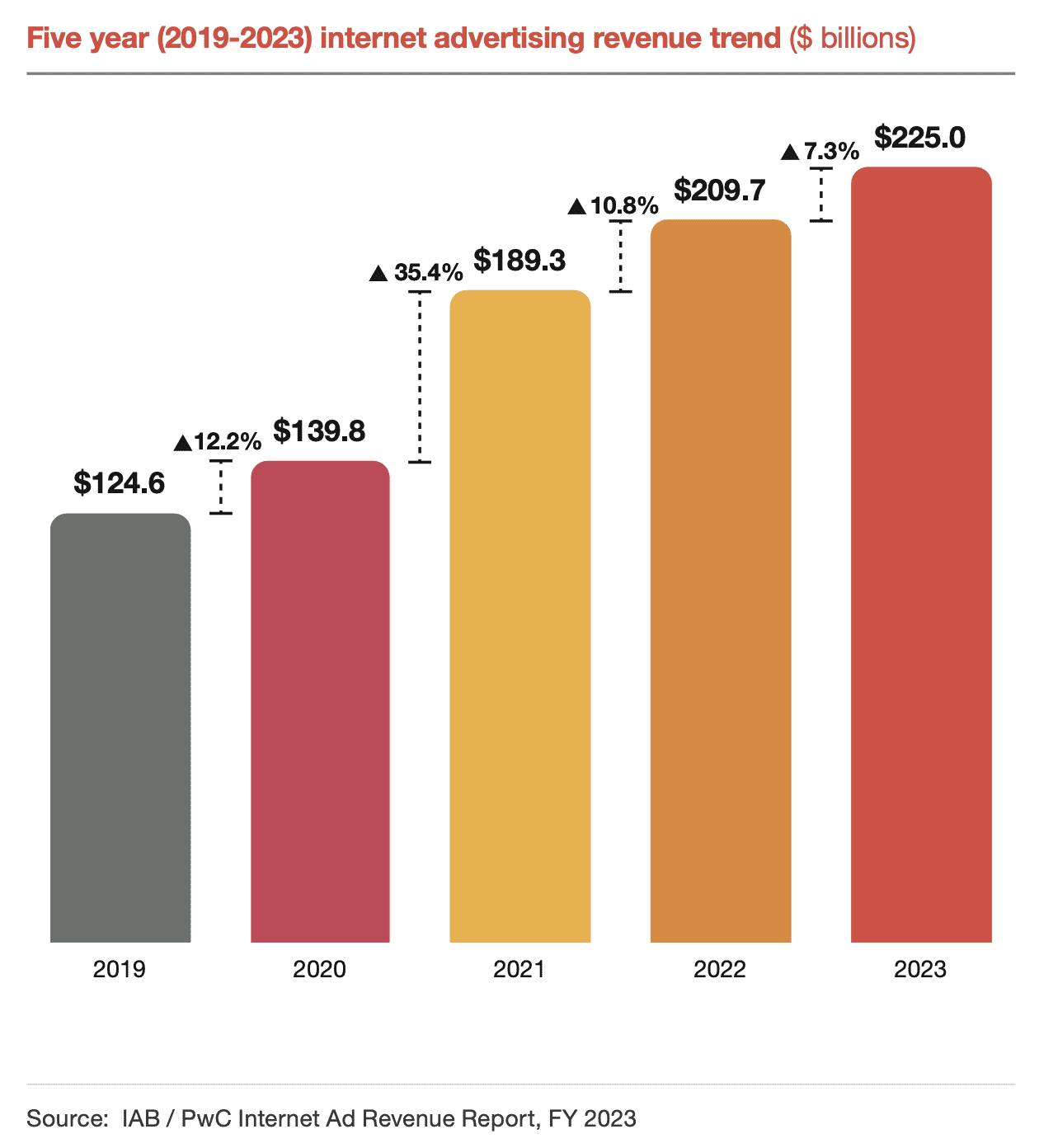

If you have been faithfully investing your marketing budget in online advertising despite gloom-and-doom predictions of an economic recession, you are in good company. The latest IAB/PwC Internet Advertising Revenue Report reveals that online advertising has remained strong over the past year, growing at a 7.3 percent rate to hit a record high of $225 billion. Search still represents a substantial portion of ad spend, but we are seeing its rate of growth slow significantly. Meanwhile, connected TV (CTV) and social media have demonstrated particularly strong growth. The report also found that online advertising spend is picking up momentum: Q4 2023 saw the highest growth rate of 12.3 percent from the year prior (4.4 percent), with revenues rising to $64.5 billion. Let’s unpack the results and understand where the opportunities for growth exist for advertisers.

Strong Advertising Growth

The online advertising space remains strong. Businesses have been willing to look past some pessimistic predictions of economic stagnation over the past few years. Economists have been wrong time and again, notably by forecasting that that the conflict in Ukraine would trigger a global recession. Economists’ inability to read the signals partly stems from unpredictable consumer behavior. This is noteworthy because consumer behavior drives online advertising. And advertisers who have stayed focused on the continued adoption of digital by consumers have wisely stayed committed to digital – both the tried and true (search) and emerging formats (CTV).

As IAB CEO David Cohen said, “Despite inflation fears, interest rates at record highs, and continuing global unrest, the U.S. digital advertising industry continued its growth trajectory in 2023. With significant industry transformation unfolding right before our eyes, we believe that those channels with a portfolio of privacy-by-design solutions will continue to outpace the market. For 2023, the winners were retail media, CTV, and audio which saw the highest growth.”

Search Growth Slows Down, while CTV and Social Pick Up Steam

So, if the online advertising market remains strong, what’s driving the growth? Maybe a better question would be: what isn’t driving the growth? In fact, advertisers are investing into digital across the board.

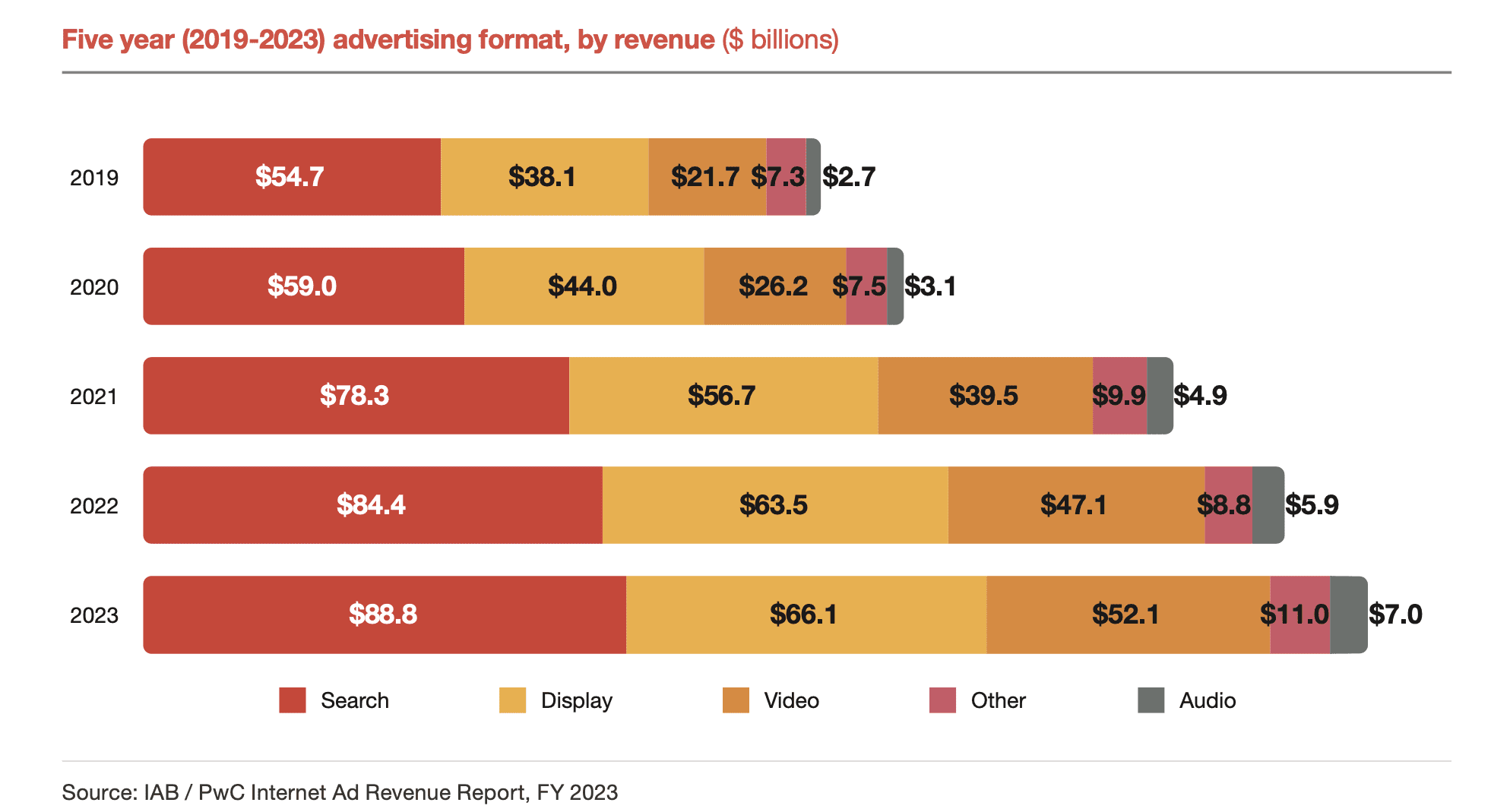

Search

Search advertising maintained the largest share at 39.5 percent of total revenues, but its growth rate is flattening out. The 5.2 percent growth rate for search advertising was lower than that of the online advertising sector. Why the slower rate of growth? Because likely advertisers are pivoting to video formats such as CTV. But search advertising remains a cornerstone of digital marketing strategies for several reasons, underpinning its enduring popularity even as the digital advertising landscape evolves. Search advertising still captures user intent. And search advertising continues to offer clear, quantifiable metrics such as click-through rates (CTR), cost-per-click (CPC), and conversion rates, which allow advertisers to measure the effectiveness of their campaigns directly. This data-driven approach enables businesses to optimize their ad spend for better returns.

Display

Revenues remain high, totaling $66.1 billion in 2023, but display achieved a year-over-year growth of 4 percent, down from 12 percent growth in 2022. As with search, the lower rate of growth is happening because advertisers are shifting their attention to formats such as CTV. But obviously, display remains a preferred channel based on growth. Display advertising networks, including Google Display Network and various programmatic platforms, offer extensive reach across millions of websites. This allows advertisers to reach a broad audience across different segments and demographics.

Video/CTV

Video advertising, CTV and online video (OLV), continued to grow, with video revenues comprising 23.2 percent of the total ad revenue. Audio formats like podcasts and streaming music saw an 18.9 percent increase, outperforming other formats. The real star here is CTV. There has been a significant shift in how audiences consume media, with more viewers moving away from traditional cable TV to streaming services available on CTV platforms. This shift is driven by the convenience, variety, and control over viewing content that streaming services offer. CTV allows advertisers to target specific demographics, interests, and viewing behaviors more precisely than traditional TV. This targeting is powered by data analytics and user profiles, enabling advertisers to deliver personalized ads to each household or viewer.

Retail Media Networks

Retail media networks experienced a robust 16.3 percent growth, indicating a shift towards targeted advertising on eCommerce platforms, which is likely to persist as retailers capitalize on the value of their their digital channels. One of the big reasons for their popularity is that retailers collect extensive first-party data from their customers through transactions, loyalty programs, and browsing behaviors. This data is immensely valuable for advertisers because it is precise, consent-based, and reflective of actual consumer behavior, allowing for highly targeted and personalized advertising campaigns.

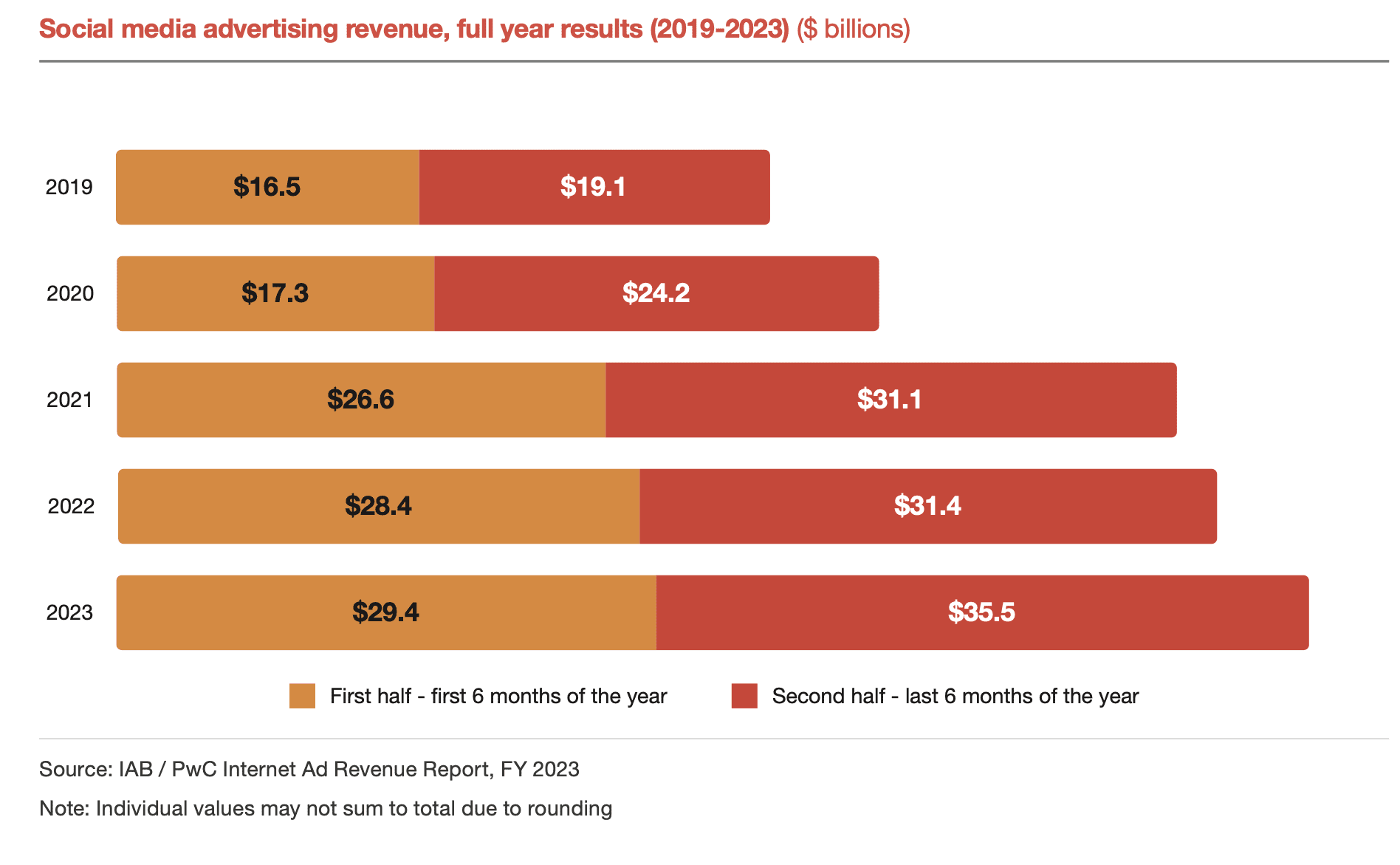

Social Media

After a slowdown, social media advertising rebounded with an 8.7 percent increase. Social media platforms have increasingly leaned into user-generated content to drive engagement and ad revenue. This content type, being authentic and relatable, resonates well with audiences, making the ads more effective. In addition, the expansion of eCommerce through social media platforms has played a critical role. Platforms have integrated more eCommerce capabilities, such as shoppable posts and direct checkout features, making it easier for users to make purchases directly from the ads.

Recommendations for Advertisers

How should advertisers invest going forward based on the findings of the report? Well, as always, the behavior of your customers should guide your answer more than anything else. But based on the report, I recommend the following:

- Search: use the rich data available through search platforms to target ads based on user intent, location, device, and even time of day. Customizing ads to these variables can significantly increase their relevance and effectiveness. Employ AI-driven tools and automation for bid management and keyword optimization. These technologies can help manage campaigns more efficiently, dynamically adjusting bids and reallocating budgets to maximize ROI.

- Display: invest in high-quality, visually appealing ad creatives that stand out. Consider the use of rich media ads that include interactive elements or video to increase engagement rates. Take advantage of programmatic display advertising for its efficiency and precision in placing ads. Use data-driven insights to target audiences more accurately and at scale.

- Connected TV (CTV) advertising: allocate a portion of your budget to test different CTV platforms to see which ones yield the best engagement and conversion rates for your target audience.

- Retail media networks: partner with prominent retail media networks, especially those that align with your product categories, to benefit from their data and targeting capabilities.

- Programmatic advertising: invest in programmatic channels but focus on private marketplaces and direct deals to ensure quality placements and audience targeting.

- Social media and user-generated content: continue to invest in social media but also explore emerging platforms and features like augmented reality filters, interactive ads, and shoppable posts to engage younger demographics and drive direct conversions.

- Audio advertising (podcasts and streaming music): develop audio-specific content and ads tailored to the interests of your target audiences. Consider sponsoring podcasts or creating branded content that resonates with listeners.

At True Interactive, we’ve been helping our clients maximize their digital ad spend since the dawn of digital. To learn about our client successes, visit our website and read our case studies about digital advertising.