Amazon has announced that Amazon Prime Day 2022 was the biggest Prime Day Event ever. Prime members purchased more than 300 million items worldwide during Prime Day 2022, which took place July 12-13. Amazon did not disclose sales results, but the 300 million items purchased was up from 250 million in 2021, and research firm Numerator estimates that spend per household neared $200, up from the high $150’s in years past. This is an impressive measure especially amid soaring inflation. So, who is buying all this stuff, what are they buying, and how are they buying? This is a significant question. The answers give advertisers clues about online purchasing behavior during inflationary times. Well, Numerator took a close look at the numbers. And they say a lot.

Women Drive eCommerce

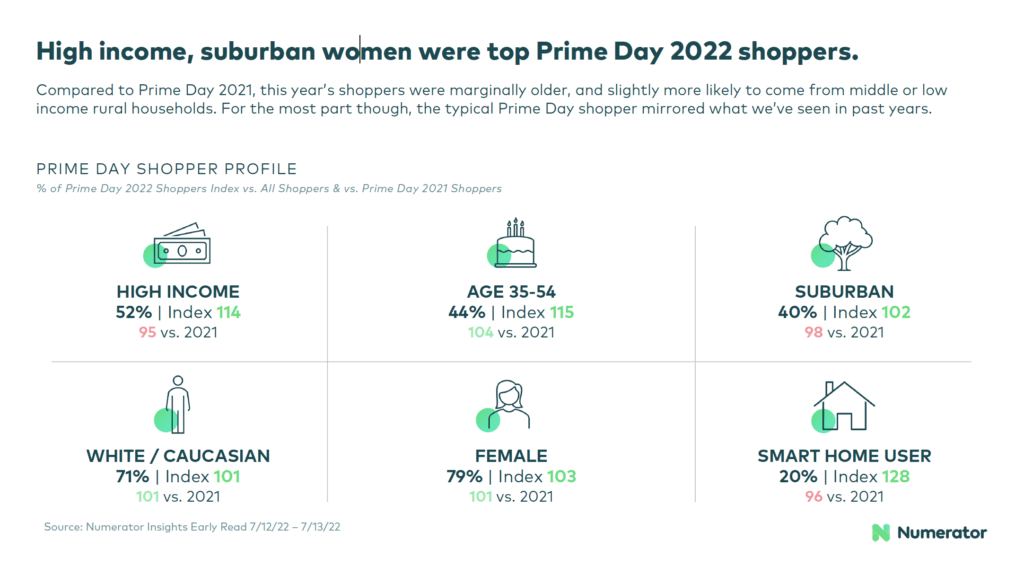

High income, suburban women were top Prime Day 2022 shoppers. Compared to Prime Day 2021, this year’s shoppers were marginally older, and slightly more likely to come from middle or low income rural households.

These figures validate why brands market to women. Women are responsible for most purchases in a typical household, and since there are 3.9 billion women in the world, marketers are eager to gain as much of their spend as possible. But marketers need to be mindful to tailor their advertising to women – for example by respecting their diversity and steering clear of tired themes (such as always depicting moms as caretakers and nurturers).

Amazon Wins by Tapping into Its Customer Base

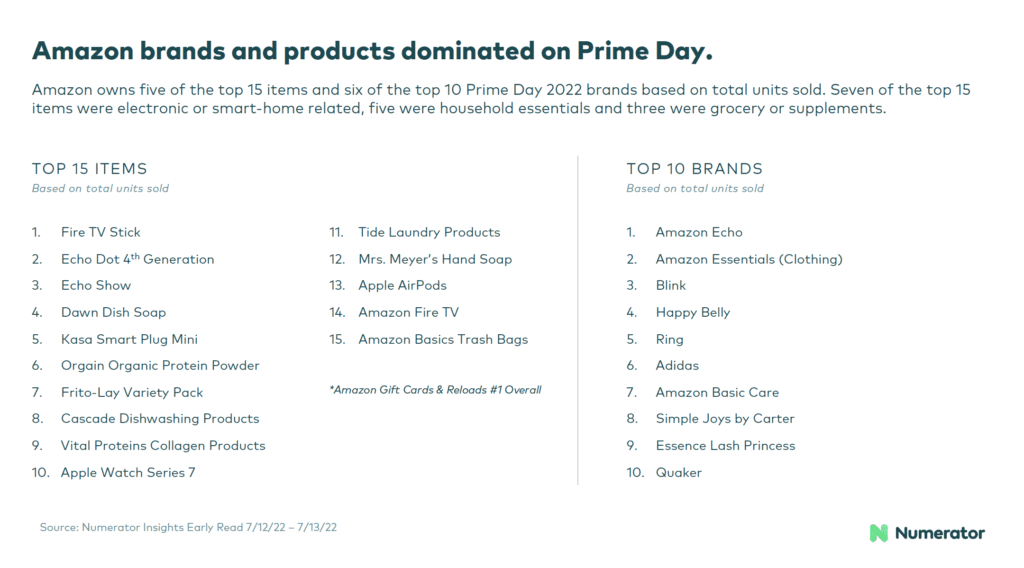

95 percent of households knew it was Prime Day before shopping, and most learned about the event directly from Amazon. Among those who were aware of the sale, 41 percent say it was the primary reason they shopped on Amazon and another 42 percent said it was a contributing factor. And Amazon dominated the list of most popular products sold.

These numbers underscore the power of Amazon to capitalize on its built-in customer base by promoting big ticket events to them. Amazon has successfully developed hundreds of in-house products and brands, and the company knows how to market them to Prime members.

This will pressure businesses to get out in front of big-tent sales such as Back-to-School, Black Friday, and Cyber Monday even more so than they have, especially by re-marketing and advertising to their own customers. This is especially true during inflationary times. One third of Prime Day shoppers waited to buy something until Prime Day, with another 17 percent using the event as an opportunity to stock up on sale items. On the flip side, over a fourth of Prime Day shoppers passed up a good deal on a non-necessity. Businesses will double down on special sale days in 2022, knowing that their customers may very hold out for promotional specials to maximize savings.

It’s also worth noting that Amazon didn’t dominate every product sold, with products such as Dawn Dish Soap, Frito-Lay, and Tide doing well. Businesses have learned that it’s better to join Amazon than to try and beat the retailing giant. And retailers who tried to compete with Amazon by creating their own quasi-Prime Day events did not succeed: although 54 percent of Amazon Prime customers considered buying from other retailers during Prime Day (particularly Walmart and Target) only 24 percent actually made purchases elsewhere in addition to Amazon, with about one-in-ten still considering a non-Amazon purchase at the time they were surveyed.

This is why Amazon Ads is succeeding: the company has monetized all the data it collects about its customers and developed attractive ad units for companies that want to reach them. The advertising arm of Amazon achieved 32 percent year-over-year growth in 2021, which amounted to $31.2 billion in revenue. Amazon Ads will continue to be a huge growth engine for Amazon, as more businesses try to reach the customers searching for things to buy on Amazon every day. (Amazon is now bigger than Google for product searches.)

Live Stream Shopping Is on the Rise

Amazon noted that Amazon Live Prime Day streams had more than 100 million views. Thousands of users hosted livestreams during this year’s event, Amazon said. Livestreaming makes it possible for advertisers to sell products via live demonstrations and promotions. Live shopping is especially big in China: according to eMarketer, live shopping accounted for nearly 12 percent of China’s retail ecommerce sales in 2021. Coresight Research estimates the live-stream shopping market will reach $20 billion in 2022 and grow to roughly $65 billion by 2023. Several livestream platforms have proliferated. But livestream shopping needs to be done well, with great production values and authentic, engaging personalities to connect with shoppers. This is why businesses are turning to ready-made platforms such as Amazon Live.

Contact True Interactive

To succeed in Amazon’s world, contact True Interactive. Our experience with Amazon Ads makes us well suited to help your brand succeed all year-round.