For decades, watching NFL games on television has meant gathering in front of a TV set and watching a game on one of the major networks. NFL games have been events that vanquish the competition. Featured programming such as Sunday Night Football, Thursday Night Football, and Monday Night Football have dominated viewer ratings. All of this is still the case. But how we watch football is changing.

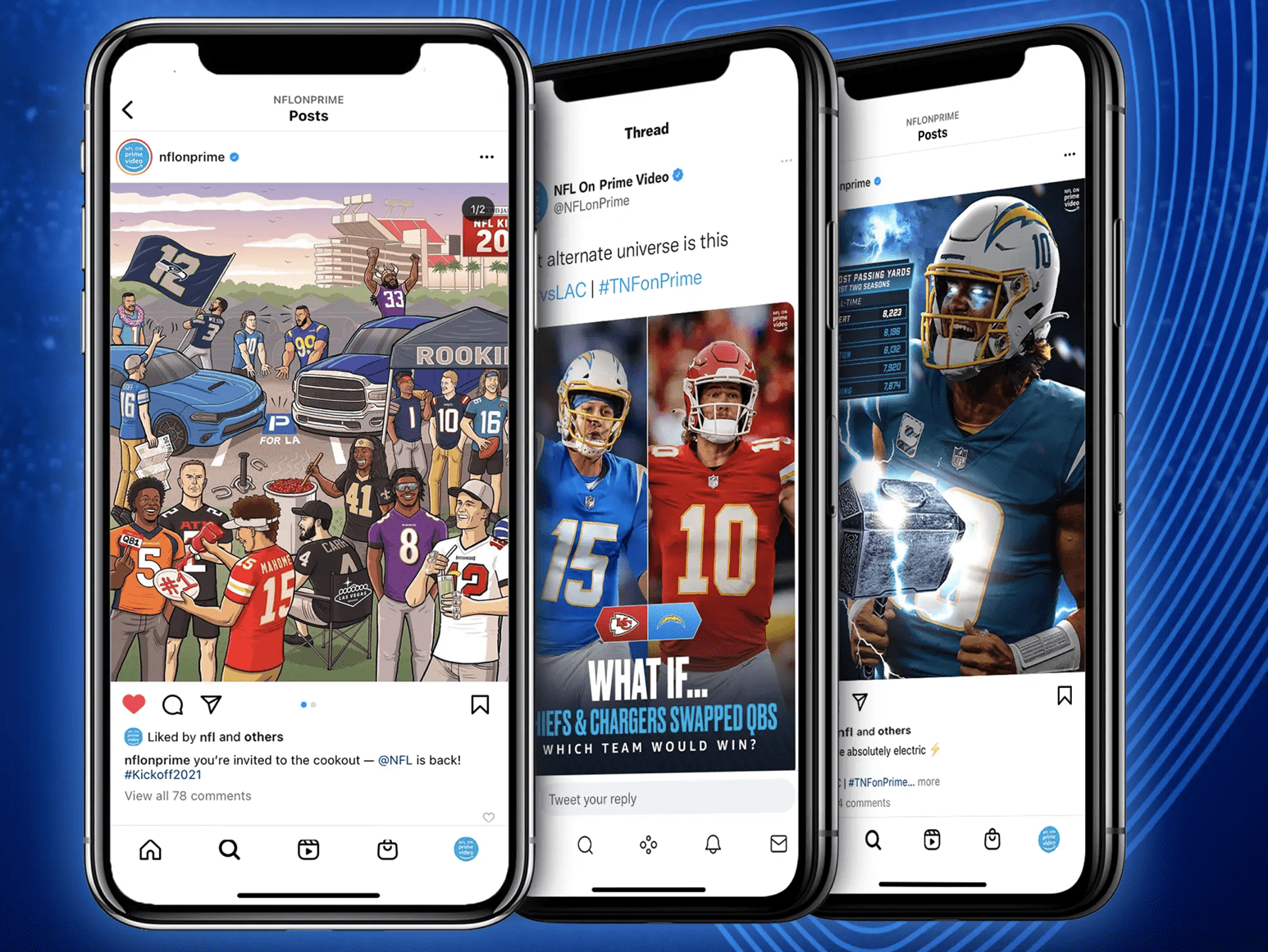

On September 15, the NFL officially entered a new era of television broadcasting when the Kansas City Chiefs and Los Angeles Chargers took the field for Thursday Night Football. Instead of televising the game on an established linear TV network, the NFL streamed the match-up on Amazon Prime as part of a $13 billion, 11-year deal with Amazon.

The game marked the NFL’s official embrace of streaming. It also meant that to watch TNF going forward, football fans would need to sign up for Amazon Prime, which is Amazon’s premium service costing $139 annually. And so far, it looks like fans are willing to pony up. According to an internal Amazon memo, the September 15 broadcast drew a record number of Prime sign-ups for a year-hour period.

Given the popularity of the NFL – easily the most dominant brand on TV based on viewer ratings – the streaming agreement has significant ramifications for advertisers. Notably, this is a victory for connected TV, which means watching TV content through a device such as Roku or Amazon Fire. Many people refer to connected TV as over-the-top (OTT) TV, which refers to streaming content directly over the internet instead of cable, broadcast, and satellite television platforms. Although technically the two terms differ – with connected TV referring specifically to the device people use to stream content – for all intents and purposes, they are the same. Whatever you want to call it, connected TV has arrived: streaming is now more popular than cable. It’s no longer optional for businesses to have an OTT advertising strategy.

Connected advertising is similar to linear TV advertising because both formats rely obviously on video. But connected TV is different in many important ways. For one thing, advertisers need to understand how to create video content that will reach viewers across a variety of viewing devices in addition to TV screens, and connected TV ads are competing with multiple content streams. (You can watch TNF on a laptop, mobile phone, or gaming console with multiple screens open.)

And each streaming service and connected TV device (ranging from Amazon Fire to Roku) offer their own ad units. For example, Amazon Ads, which is Amazon’s fast-growing advertising business, offers ad units such as inline ads (which appear as selectable rows in each major browsing section of Fire TV) and feature rotator (a carousel-like ad placement appearing above the fold of the screen).

Ahead of the launch of TNF on Amazon Prime, Danielle Carney, Amazon Ads’ Head of NFL Sales, said:

We’re offering myriad opportunities to get involved with TNF, catering to brands’ range of needs. Our premier sponsorships give advertisers the ability to elevate their brands during the pre-game, pre-kick, halftime, and post-game shows. But that’s not all. We’re continuing to innovate and explore other potential sponsorships and packages that will enable brands tell their stories in unique ways through our surround, alternate feeds, and ancillary programming. Our newly built creative sports team will help customize the experience for our partners.

Outside of sponsorships, brands can use Streaming TV ads to reach fans throughout games on Prime Video and Twitch. Like our sponsorships, these video ads are backed by Amazon’s first-party insights, bringing more value and insight into campaign performance for brands.

To succeed, though, Amazon Prime needs to deliver viewing numbers to advertisers. Reportedly, Amazon has told advertisers that it expects to see nightly viewership of about 12.5 million people for its inaugural season of TNF. We’ll soon see. Amazon agreed for Nielsen to track ratings for TNF, and ratings for the September broadcast are still forthcoming.

Amazon Prime also needs to deliver a desirable experience. Amazon promises alternative ways to watch TNF, including Dude Perfect, a popular trick-shot comedy group. Amazon Fire TV and Alexa are bringing new features to NFL fans as well, such as trivia and real-time access to statistics (which should appeal to Fantasy Football devotees). Early fan reactions to the September 15 broadcast were mixed, and it looks like Amazon has some technical issues with content buffering to fix. Of course, no one can predict the quality of an actual NFL game, but Amazon can certainly deliver on the overall experience. Let’s see how Amazon adapts.

The broadcast is also significant for another reason: a victory for first-party data, which is the information that businesses collect directly from their customers. Amazon will use first-party data to sell targeted ads to help drive revenue for the games. This is huge. Right now, third-party audience data is withering away thanks to Apple’s and Google’s privacy measures. Businesses that figure out how to monetize first-party data enjoy an enormous advantage. Amazon has already become the third biggest ad platform in the world (behind Google and Meta) by using first-party data to sell targeted ads. The ascendance of first-party data is one reason why retailer-based ad networks have become so popular.

Bottom line: what is your advertising game plan for connected TV?

Contact True Interactive

To succeed with connected TV advertising, contact True Interactive. We have deep experience with this format.