What does the holiday shopping season hold for businesses? We have already heard plenty about the potential problems that a global supply chain crisis will pose. They include product shipping delays, bare shelves, and higher prices. But how are consumers planning to research and buy as the shopping season kicks into full gear? A recently conducted webinar by ChannelAdvisor, “Navigating Online Consumer Behavior: 2021 E-Commerce Trends and Forecasts,” provided some answers.

ChannelAdvisor and Dynata surveyed 5,000 global consumers to learn how they are shopping this holiday season, including 1,000 U.S. consumers. ChannelAdvisor also relied on secondary research from sources such as eMarketer. Here are some major takeaways:

E-Commerce Is Exploding

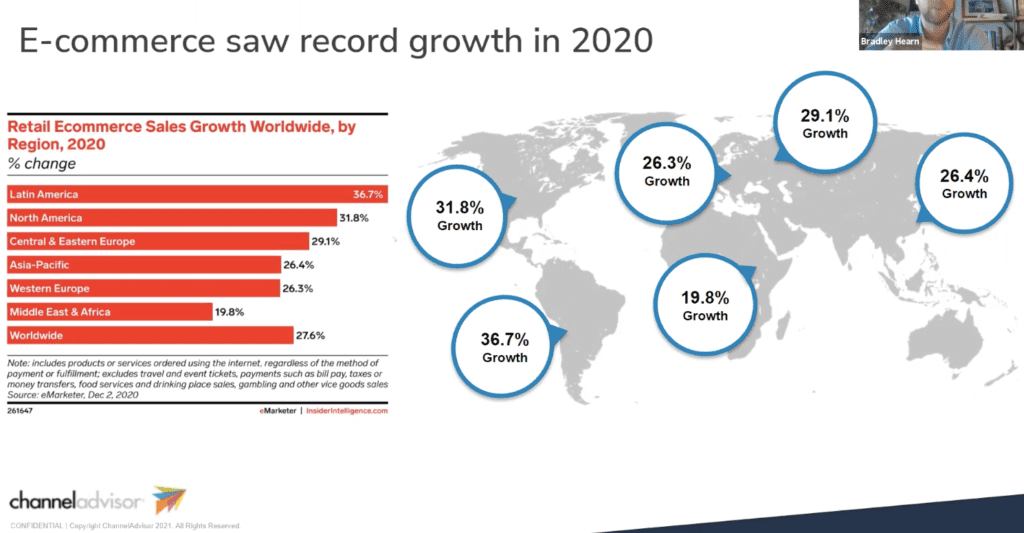

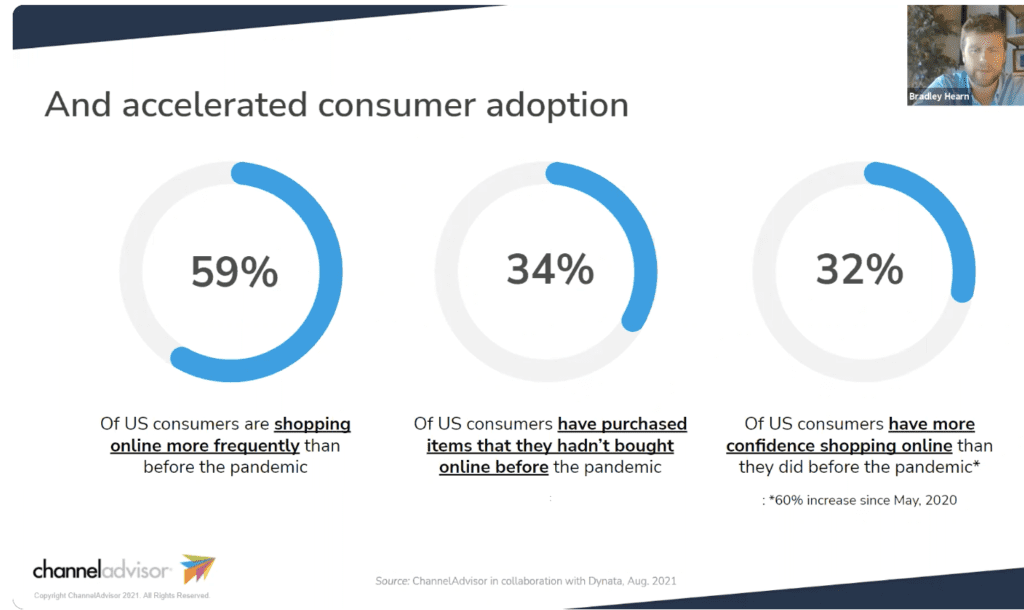

E-commerce has accelerated by two-to-three years as a percentage of total retail sales. ChannelAdvisor says that the accelerated pace will continue for the next few years. That’s because Covid-19 forced more shoppers online. Nearly 60 percent of consumers are shopping online more frequently than before the pandemic, and 32 percent of U.S. consumers have more confidence shopping online than they did before the pandemic. A whopping 58 percent of consumers are spending more time on Amazon.

Key takeaway: businesses should expect the major ad platforms such as Amazon, Facebook, Google, Instagram, Snapchat, and TikTok to integrate advertising and commerce more aggressively. We recently saw Google make it easier for shoppers to find products through visual search and display. TikTok continues to launch new shopping features. It’s important that businesses capitalize on these opportunities to capture revenue in these moments when people are searching and browsing on digital.

Get Ready for a Strong Holiday Shopping Season

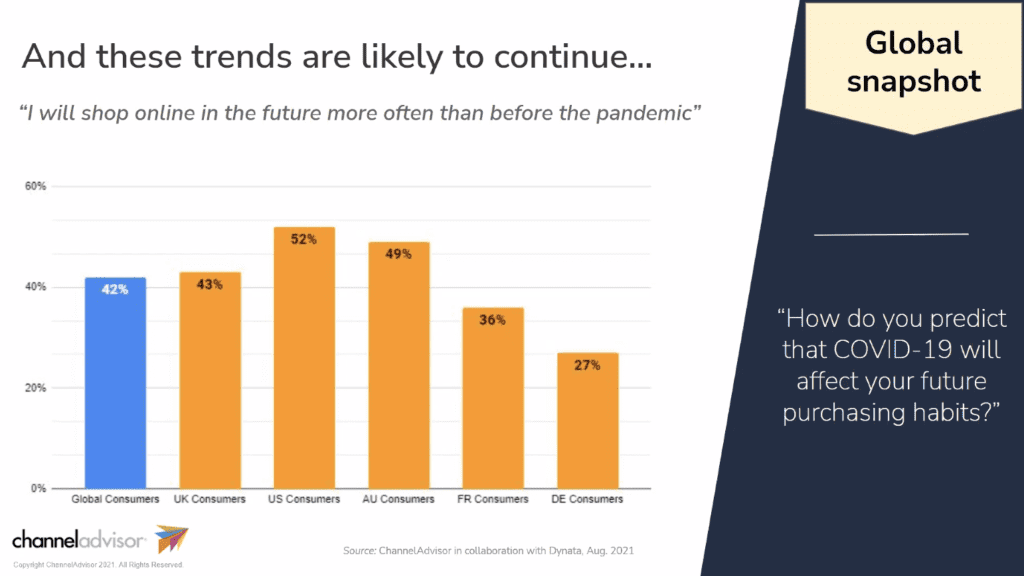

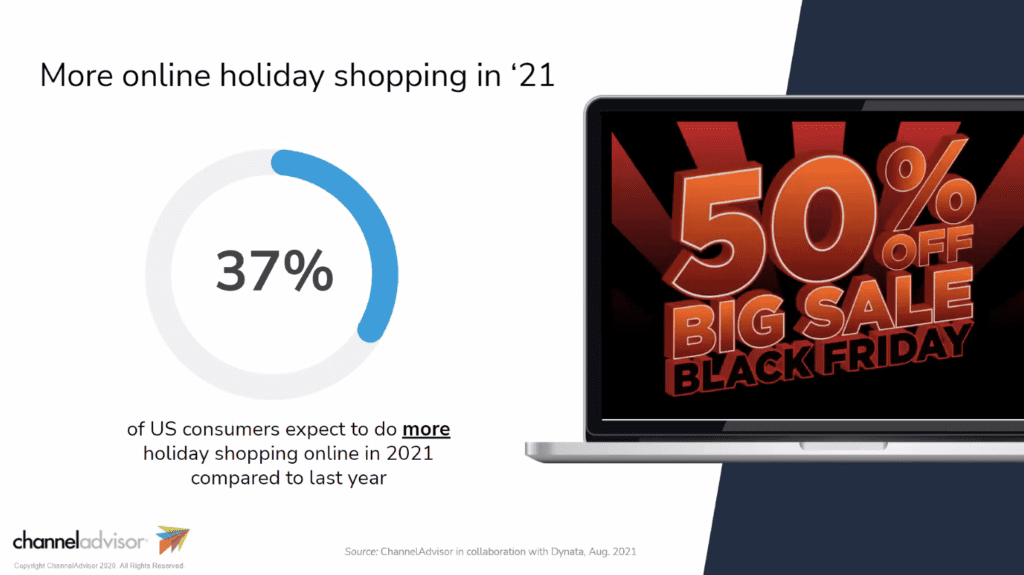

More than half of U.S. consumers will shop online more than before the pandemic. By contrast, 38 percent of U.S. consumers said they’d shop more online when they were surveyed in May 2020. And 37 percent of U.S. consumers expect to do more holiday shopping online compared to 2020. Only 6 percent of shoppers will shop less.

This finding is not surprising. We saw that even during the hardest days of the pandemic when the world faced economic uncertainty, consumers were willing to open up their pocketbooks and spend. But as ChannelAdvisor noted, much of that spending happened online.

Key takeaway: it’s going to be a busy holiday shopping season, and savvy advertisers are already ramping up their holiday shopping advertising. According to Deloitte, consumers will spend 9 percent more this holiday season compared to 2020. A new survey from JLL says that consumers plan to spend an average of $870 per person on holiday expenses this year, a 25.4 percent increase from last year. Consumers are ready to shop. On the downside, if the global shipping crisis is as bad as economists say it’s going to be, those consumers may experience the disappointment of product shortages. So advertisers are encouraging people to shop sooner while inventory is in stock.

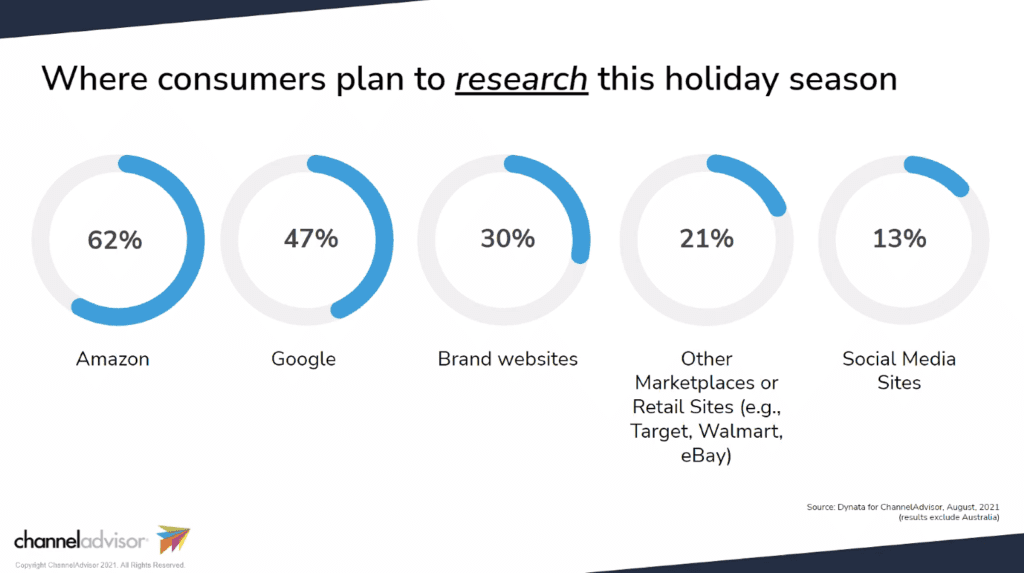

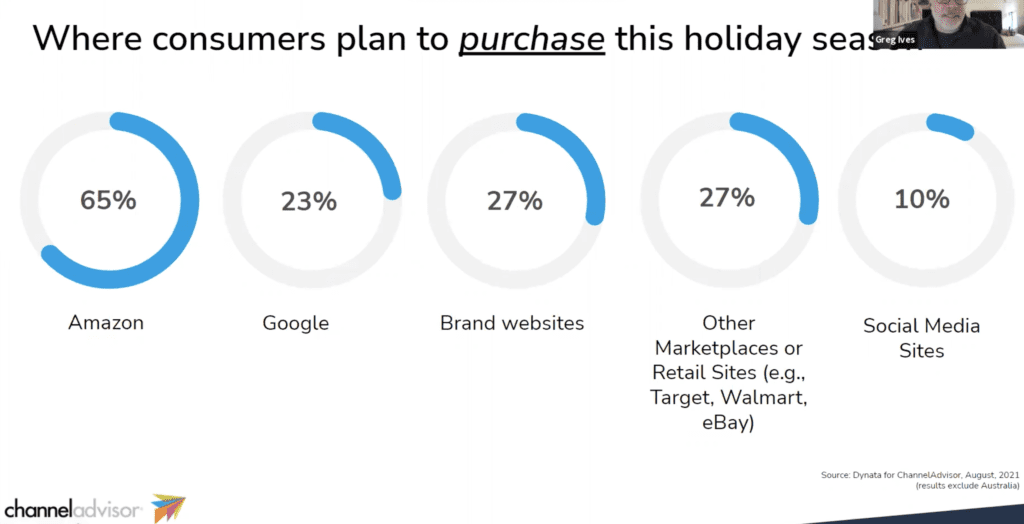

Amazon and Google Dominate Product Research and Purchase

Amazon is the Number One destination for people to research product: 41 percent use Amazon to research products. Google, though, is a strong second place finisher. Amazon has built strong trust because when people are checking reviews, prices, and product inventory, Amazon gives them one easy place to do all that. During the holiday shopping season, even more consumers will do research on Amazon, and 65 percent will purchase on Amazon.

Key takeaway: capitalizing on Amazon Advertising products is a must if you want your brand to be visible when shoppers are doing deep product research. But don’t shift your ad budget from Google if you’re already a Google Ads customer. A two-pronged approach works best.

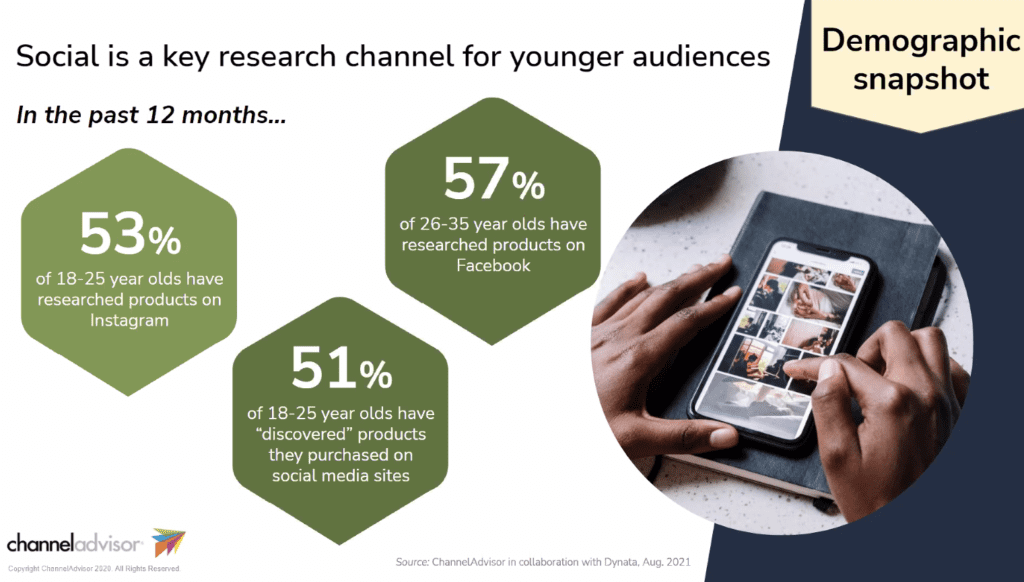

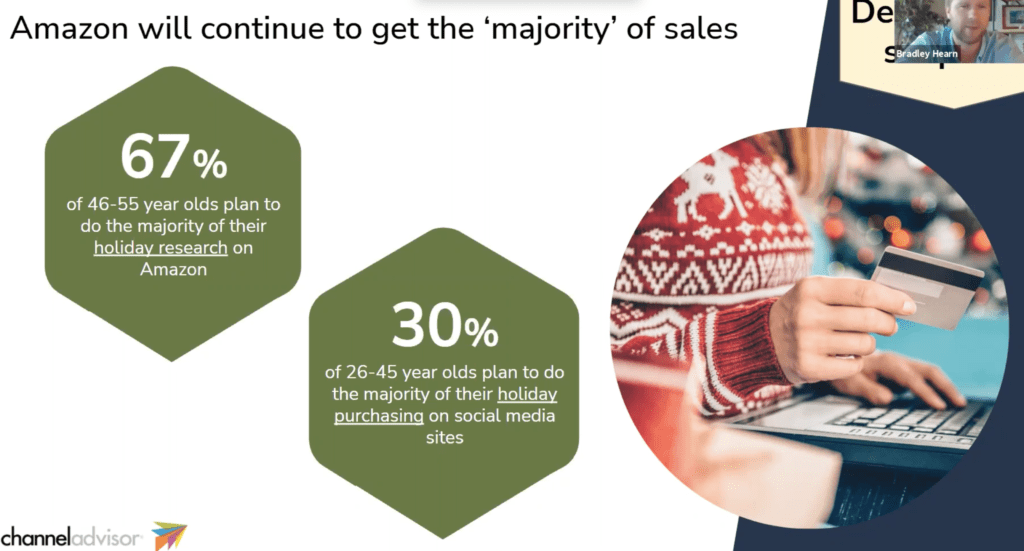

Social Media Is More Important for Younger Audiences

Social is the key research channel for younger audiences. 53 percent of 18-to-25 year olds have researched products on Instagram. 51 percent have discovered products they purchased on social media sites. Facebook remains a strong source of product research for 26-to-35 year olds. Meanwhile, 30 percent of 26-to-45 year olds will do the majority of their holiday purchasing on social sites.

Key takeaway: although social media sites lag far behind Amazon and Google for product research, they index high for Millennial and Gen Z shoppers. Given the popularity of Instagram as a shopping destination, it’s important that advertisers capitalize on Instagram ad products such as Instagram Shop to reach younger shoppers. Essentially, Instagram ad products make it possible for businesses to turn posts and stories into ads. Instagram also makes it possible to create ads across Instagram and Facebook, which sounds very efficient – but remember that what works on Instagram might not be as effective on Facebook because Facebook appeals to a slightly older audience.

For more insight into holiday shopping trends, read a recently published True Interactive post, “How Retailers Can Prepare for the Holiday Shopping Season.”

Contact True Interactive

To maximize the value of your holiday shopping ad campaigns, contact True Interactive. We help our clients create effective online advertising all year-round, including the holiday season, and we understand the nuances of creating effective holiday ad campaigns.

Photo by Jakob Owens on Unsplash