A global supply chain crisis has created uncertainty for manufacturers and retailers alike. How are these problems changing the way business advertise for merchandise that may or may not be available when consumers shop?

The problem many advertisers – especially retailers – face right now is uncertainty of product availability. This is a different problem than scarcity. When a product is scarce, but retailers can predict how many units they will have on hand during the holiday season, they can set ad budgets with confidence. But when a business has no idea how many products it will stock, figuring out how to stoke demand with advertising becomes very tricky.

For example, as reported in Advertising Age, Jay Foreman, CEO of toy company Basic Fun, usually sends new products to influencers for promotion through product unboxing videos. But this year, he’s being more cautious because he cannot predict with certainty whether retailers will be able to carry his products.

“I don’t want to get the influencers going and the merchandise is not in store yet,” he said. “The consumer views that [influencer] unboxing and they’re like, ‘Cool, let’s buy it now,’ and if it’s not there, they’re not going to look at that unboxing video again.”

According to Ad Age, some advertisers are scaling back their ad spend. But many others are taking a more nuanced approached that we recommend:

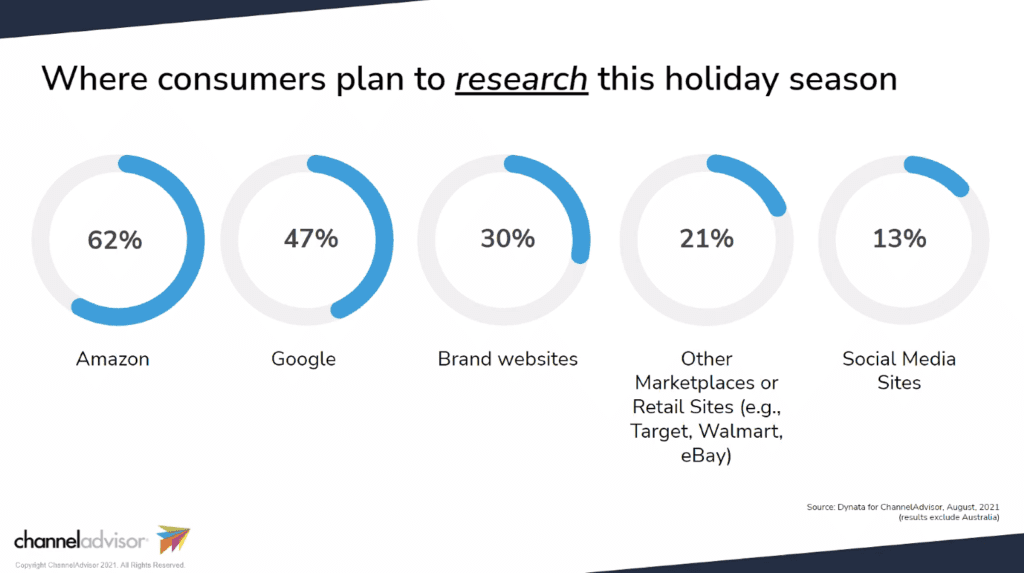

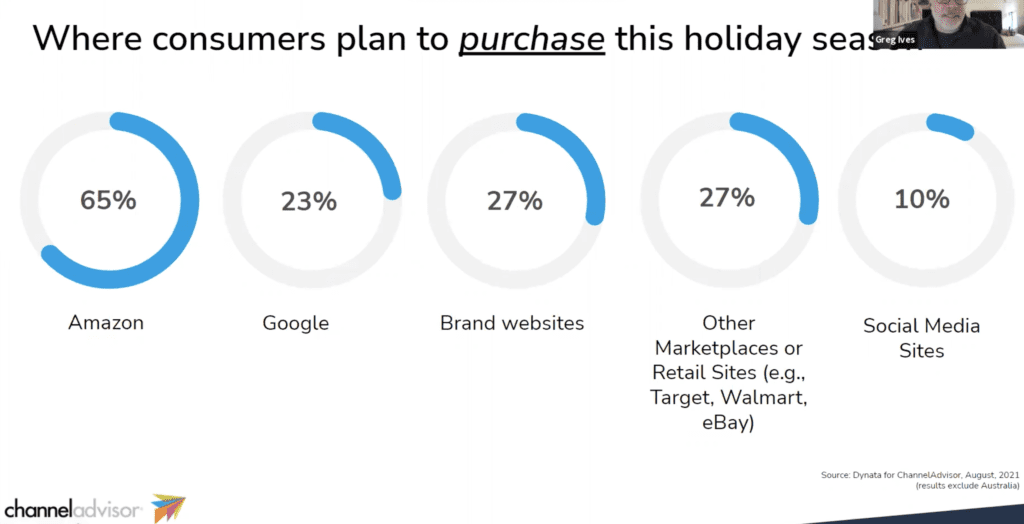

- Shift offline advertising to digital. Tactics such as paid search give advertisers more flexibility to calibrate their spend as supply-and-demand levels fluctuate. National Tree Company, which sells artificial trees and holiday décor, will focus its advertising on online search with some social media advertising as part of the mix. This approach makes sense especially as more product research and purchases occur online:

Because Amazon and Google dominate product research and purchase, look toAmazon Advertising and Google’s many ad units to capture holiday spend. By the way, Amazon Advertising offers ad units for businesses even if they don’t sell products on Amazon. Those ad units include Sponsored Display and Video Ads.

- Increase advertising now. Many businesses are ramping up their advertising to encourage shoppers to buy products as soon as possible before retailers run out of products. We noted a “buy now while you can” surge in holiday promotions weeks ago. Those promotions are coming from big, well known retailers such as Target and Walmart. Be aware that when big retailers launch holiday promotions, they create general consumer awareness of the holiday shopping season. As a result, retailers should expect an uptick in searches for holiday sales and promotions. Now might be a good time to capitalize on that increased search activity to activate your own campaigns.

- Keep brand advertising spending levels strong. As Ad Age noted, auto makers are promoting their 2022 models even though a global chip crisis has created a short-term shortage of available inventory at dealerships. Per Ad Age, “Auto brands continue to push out broader marketing campaigns touting new vehicle launches, including Toyota, which this week rolled out a new campaign for the 2022 Tundra pickup truck that it described as the largest U.S. ad campaign for a new vehicle launch in Toyota’s history.Ad spending cutbacks are more likely for locally-focused ads aimed at getting people to dealers for sales events.”

Whatever you do, don’t cut advertising because of uncertainty. Procter & Gamble’s approach during the Covid-19 pandemic offers a great lesson as to why. To say that the early days of the pandemic created uncertainty is a massive understatement. Businesses everywhere faced economic uncertainty and a global supply chain crisis (yes, the supply chain crisis was going on back then – it just was not getting the attention it is now). And who can forget the great toilet paper panic of 2020, when a spike in consumer demand resulted in retail shelves being stripped of this essential product? Procter & Gamble was affected by this uncertainty – the company manufacturers toilet paper brands as well as many other household products that faced shortages. But Procter & Gamble kept advertising, and as a result, the company’s earnings in 2020 exceeded analysts’ projections.

As Vice Chairman and Chief Financial Officer Jon Moeller said, “We view this as a time to spend forward in terms of our advertising levels, not to spend back. First, there’s never been more media consumed than there is currently, as we all try to entertain ourselves and our families and survive. And two there’s a heightened need to spend on hygiene and health.”

Procter & Gamble was, and is, looking at the long game: before the pandemic, people were spending more time online, and the pandemic accelerated that behavioral shift. The company understands that although demand and supply for products will always fluctuate, the long-term shift in behavior is here to stay. So, Procter & Gamble is taking its ad spend to where shoppers are: online.

How about you?

Contact True Interactive

How can your brand benefit from digital advertising? Contact us. We can help. Read some of our case studies here.

Photo by Cameron Venti on Unsplash

True Interactive Blog Posts for Additional Insight

“Consumer Shopping Trends for the 2021 Holiday Season”

“Why Big Retailers Are Ramping up Holiday Shopping Promotions – and What Advertisers Should Do”

“Why Google Is Doubling Down on E-Commerce”

“How Retailers Can Prepare for the 2021 Holiday Season”

“Five Lessons Learned from the 2021 Ad Spending Surge”

“Why Procter & Gamble Is Succeeding (Hint: Advertising!)”

“Why Businesses Need to Step up Their Digital Advertising in 2021”